More and more people are using nicotine pouches instead of cigarettes and other smokeless tobacco products. But there is still one important question for Wisconsin consumers and retailers: Are nicotine pouches subject to the state’s tobacco tax? Buyers, sellers, and distributors can better follow the state’s laws if they know how these products are regulated.

What you need to know about nicotine pouches

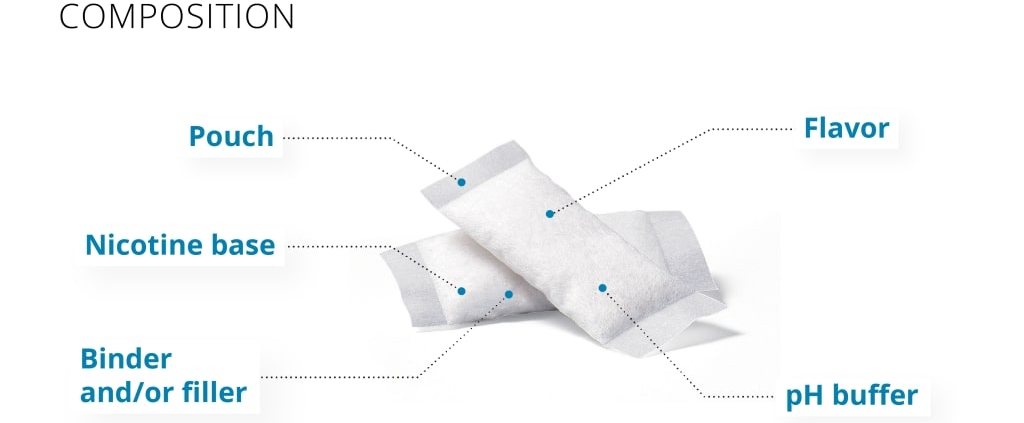

Nicotine pouches are small, tobacco-free, and spit-free oral products that deliver nicotine through the gums. They don’t have any tobacco leaves in them, unlike chewing tobacco or snus. Because of this difference, they are in a legal gray area in many U.S. states, including Wisconsin.

A Quick Look at the Wisconsin Tobacco Tax

Wisconsin charges excise taxes on common tobacco products, such as:

- Cigarettes are taxed by the pack.

- Tobacco, snuff, and moist snuff are all taxed by weight.

- Cigars and small cigars are taxed based on how much the manufacturer sells them for.

But these groups don’t say anything about nicotine pouches in particular. Because the products don’t have tobacco in them but do have nicotine, their classification decides if they are taxed or not.

Are nicotine pouches taxed in the state of Wisconsin?

Wisconsin’s tobacco excise tax laws don’t say anything about taxing nicotine pouches right now because they don’t have any real tobacco in them. They are usually put in a different group than cigarettes, chewing tobacco, and other things that can be smoked or chewed.

Even so, these items are still subject to the general state sales tax when they are bought. Even if excise taxes don’t apply, retailers and wholesalers still have to collect and pay sales tax.

Why the Law Might Change

States all over the U.S. are rethinking their tax systems because more and more people are using nicotine pouches. Some states, like Alaska, Minnesota, and Oregon, have already passed or are thinking about passing laws that would tax nicotine pouches in the same way as tobacco.

Eventually, lawmakers in Wisconsin may do the same, especially as this type of product becomes more popular. This would change prices for both consumers and wholesalers, so it’s important to keep up with policy changes.

What This Means for Customers and Businesses

Consumers: Right now, nicotine pouches are cheaper in Wisconsin than in states that charge excise taxes.

Retailers: They still have to collect sales tax, follow age restrictions, and get ready for changes to the tax code that could happen in the future.

Wholesalers and distributors should keep an eye on updates from Wisconsin’s Department of Revenue to see if new tax laws could affect their margins.

Partnering with a Reliable Supplier

At Echi, we are a China-based nicotine manufacturer and supplier, specializing in:

-

Premium nicotine pouches in a wide range of strengths and flavors

-

Innovative nicotine strips designed for fast-dissolving convenience

-

Custom OEM and private-label solutions for global distributors

We focus exclusively on B2B partnerships, delivering consistent quality and compliance to meet international market needs.

In The End

Wisconsin does not currently charge an excise tax on nicotine pouches, but they do charge a general sales tax. Businesses and consumers in Wisconsin should be ready for possible changes in the future because rules are changing all over the country. To avoid compliance problems and know the real cost of these products, you need to stay up to date.

Wisconsin Nicotine Pouch Tax FAQ:

1. Do people in Wisconsin think nicotine pouches are tobacco?

No. They are nicotine products that don’t have tobacco leaves in them, so Wisconsin law doesn’t consider them tobacco.

2. Do I still have to pay taxes on nicotine pouches in Wisconsin?

Yes. You will have to pay the normal state sales tax, but there is no tobacco excise tax.

3. Is it possible for Wisconsin to add a tax on nicotine pouches in the future?

Yes. As nicotine pouches become more popular, lawmakers may suggest rules that would tax them like tobacco products.

4. Do stores in Wisconsin need a tobacco license to sell nicotine pouches?

Yes. Nicotine pouches are still age-restricted and need a retail license to sell, even though they aren’t taxed like tobacco.

5. Is the price of nicotine pouches lower in Wisconsin than in other states?

Yes, because there are no excise taxes. But this could change if new laws are passed in the future.